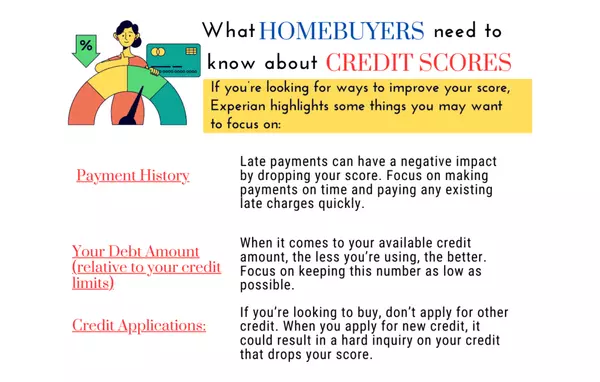

What Homebuyers Need To Know About Credit Scores

If you’re thinking about buying a home, you should know your credit score’s a critical piece of the puzzle when it comes to qualifying for a home loan. Lenders review your credit to assess your ability to make payments on time, to pay back debts, and more. It’s also a factor that helps determine your mortgage rate. An article from Bankrate explains: “Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.” This means your credit score may feel even more important to your homebuying plans right now since mortgage rates are a key factor in affordability, especially today. According to the Federal Reserve Bank of New York, the median credit score in the U.S. for those taking out a mortgage is 765. But, that doesn’t mean your credit score has to be perfect. An article from Business Insider explains generally how your FICO score range can make an impact: “. . . you don’t need a perfect credit score to buy a house. . . . Aiming to get your credit score in the ‘Good’ range (670 to 739) would be a great start towards qualifying for a mortgage. But if you’re wanting to qualify for the lowest rates, try to get your score within the ‘Very Good’ range (740 to 799).” Working with a trusted lender’s the best way to get more information on how your credit score could factor into your home loan and the mortgage rate you’re able to get. As FICO says: “While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.” If you’re looking for ways to improve your score, Experian highlights some things you may want to focus on: Your Payment History: Late payments can have a negative impact by dropping your score. Focus on making payments on time and paying any existing late charges quickly. Your Debt Amount (relative to your credit limits): When it comes to your available credit amount, the less you’re using, the better. Focus on keeping this number as low as possible. Credit Applications: If you’re looking to buy, don’t apply for other credit. When you apply for new credit, it could result in a hard inquiry on your credit that drops your score. When you’re ready to start the homebuying process, a lender will be able to assess which range your score falls in and tell you more about the specifics for each loan type. Bottom Line With affordability challenges today, prioritizing ways you can have a positive impact on your credit score could help you get a better mortgage rate. If you want to learn more, let’s connect. Check out our Beautiful Listings at https://davesalaskahomes.com/featured-listingSearch for homes easily at https://davesalaskahomes.com/listingGet your home’s estimated value instantly at https://davesalaskahomes.com/evaluation If you or anyone you know has ANY thoughts of buying or selling real estate, lets connect to talk about the opportunities available in our market and how to reach your goals. LET US BE YOUR TRUSTED GUIDE Call or text Dave now at 907-863-7289Call or text Travis now at 907-575-6779 davesalaskahomes@gmail.comhttp://www.DavesAlaskaHomes. com

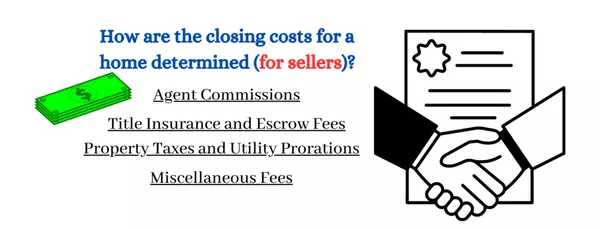

How are the closing costs for a home determined (for sellers)?

In today’s post, we’ll discuss a topic that is of particular interest to home sellers: closing costs. Closing costs can be a significant expense when selling your home, and understanding how they are determined can help you make informed decisions throughout the process. Let’s dive in and take a closer look at the factors that influence closing costs for sellers in Alaska. Agent Commissions: One of the most significant closing costs for home sellers is the real estate agent commission. In Alaska, commission rates can vary between 4% and 7% of the final sale price, depending on the specific agreement between the seller and the agent. Typically, this commission is split between the seller’s and buyer’s agents. It’s important to keep in mind that commission rates are negotiable, so don’t hesitate to discuss this with your agent. Title Insurance and Escrow Fees: Title insurance protects the buyer and lender from any potential issues with the property’s title. In Alaska, it’s customary for the seller to cover the cost of the owner’s title insurance policy. This cost is usually around 0.5% to 1% of the home’s sale price. In addition, escrow fees, which are charged by the escrow company for handling the closing process, are also typically paid by the seller. Escrow fees can vary but usually range from $500 to $1,000. Property Taxes and Utility Prorations: Sellers are responsible for paying their share of property taxes up until the date of closing. In Alaska, property taxes are usually paid on a semi-annual or annual basis. The seller will need to prorate their portion of the taxes, which will be credited to the buyer at closing. Utility prorations, such as water, sewer, or electricity, may also need to be addressed during closing, depending on the specifics of the transaction. Miscellaneous Fees: There are various smaller fees associated with selling a home in Alaska. These can include recording fees, courier fees, and attorney fees, among others. It’s essential to review the settlement statement provided by the escrow company to ensure that all fees are accounted for and to be aware of any additional costs you may be responsible for as a seller. Conclusion: Understanding closing costs is an essential part of navigating the home selling process in Alaska. By knowing which expenses to expect and how they are determined, you can better prepare for the financial aspect of selling your home. Be sure to consult with your real estate agent and other professionals involved in the transaction to ensure a smooth and successful closing. Happy selling, and until next time, stay informed and confident in your Alaska real estate journey! Check out our Beautiful Listings at https://davesalaskahomes.com/featured-listingSearch for homes easily at https://davesalaskahomes.com/listingGet your home’s estimated value instantly at https://davesalaskahomes.com/evaluation If you or anyone you know has ANY thoughts of buying or selling real estate, lets connect to talk about the opportunities available in our market and how to reach your goals. LET US BE YOUR TRUSTED GUIDE Call or text Dave now at 907-863-7289Call or text Travis now at 907-575-6779 davesalaskahomes@gmail.comhttp://www.DavesAlaskaHomes. com

How are the closing costs for a home determined (for buyers)?

If you’re considering purchasing a property in the beautiful state of Alaska, understanding how closing costs are determined is essential to help you plan your budget and avoid any unwelcome surprises. So, let’s dive in and demystify the closing costs for home buyers. What are Closing Costs? Closing costs are the fees and expenses that both the buyer and the seller need to pay when finalizing a real estate transaction. These costs can vary greatly based on several factors, such as the property’s location, the lender’s requirements, and the terms of the contract. For home buyers, closing costs typically range from 2% to 5% of the home’s purchase price. Factors Influencing Closing Costs for Buyers in Alaska: Loan Origination Fees: One of the most significant closing costs for home buyers is the loan origination fee. This fee is charged by the lender for processing, underwriting, and funding the mortgage loan. The origination fee can be a flat amount or a percentage of the loan amount, typically ranging from 0.5% to 1%. Appraisal and Inspection Fees: Before approving a mortgage, lenders require an appraisal to ensure the property is worth the loan amount. Appraisal fees usually range from $300 to $500. Additionally, home inspections are necessary to identify any potential issues with the property. Home inspection fees in Alaska can range from $300 to $600, depending on the size and location of the property. Title Search and Insurance: To protect both the buyer and the lender from any ownership disputes, a title search is conducted to verify that the seller has the legal right to sell the property. The title search fee can range from $200 to $400. Additionally, title insurance is purchased to protect against any future claims on the property. Title insurance costs in Alaska can vary, but they typically range between $500 and $1,500. Recording Fees and Transfer Taxes: Recording fees are charged by the local government to record the change of ownership in public records. In Alaska, recording fees can range from $100 to $300. Transfer taxes, on the other hand, are charged on the transfer of property ownership. Alaska has a statewide transfer tax of $2.00 for every $500 of the property’s value. Escrow and Prepaid Expenses: Escrow fees are charged by the escrow company for managing the closing process and distributing funds to the appropriate parties. These fees can vary, but they typically range from $500 to $1,000. Prepaid expenses, such as property taxes, homeowner’s insurance, and mortgage interest, are also part of the closing costs. These amounts are prorated and can vary based on the closing date. Discount Points: Some buyers choose to pay discount points, which are essentially prepaid interest on the mortgage. By paying discount points upfront, you can reduce your interest rate and overall mortgage costs. Each point typically costs 1% of the loan amount and can lower the interest rate by 0.25%. Conclusion: Closing costs are an inevitable part of the home buying process, and understanding how they are determined is essential for buyers. While these costs can be substantial, being aware of the factors that influence them can help you budget accordingly and be better prepared for your Alaska real estate transaction. As a buyer, it’s essential to work with an experienced real estate agent and lender who can guide you through the process and help you find ways to minimize your closing costs. Happy house hunting in the Last Frontier! Check out our Beautiful Listings at https://davesalaskahomes.com/featured-listingSearch for homes easily at https://davesalaskahomes.com/listingGet your home’s estimated value instantly at https://davesalaskahomes.com/evaluation If you or anyone you know has ANY thoughts of buying or selling real estate, lets connect to talk about the opportunities available in our market and how to reach your goals. LET US BE YOUR TRUSTED GUIDE Call or text Dave now at 907-863-7289Call or text Travis now at 907-575-6779 davesalaskahomes@gmail.comhttp://www.DavesAlaskaHomes. com

Categories

Recent Posts