Why Homeownership Wins in the Long Run?

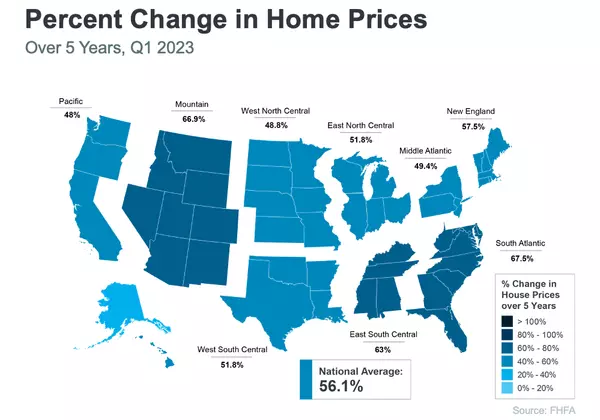

Today’s higher mortgage rates, inflationary pressures, and concerns about a potential recession have some people questioning: should I still buy a home this year? While it’s true this year has unique challenges for homebuyers, it’s important to think about the long-term benefits of homeownership when making your decision. Consider this: if you know people who bought a home 5, 10, or even 30 years ago, you’re probably going to have a hard time finding someone who regrets their decision. Why is that? The reason is tied to how home values grow with time and how, by extension, that grows your own wealth. That may be why, in a recent Fannie Mae survey, 70% of respondents say they believe buying a home is a safe investment.Here’s a look at how just the home price appreciation piece can really add up over the years.The map below uses data from the Federal Housing Finance Agency (FHFA) to show just how noteworthy price gains have been over the last five years. And, since home prices vary by area, the map is broken out regionally to help convey larger market trends. If you look at the percent change in home prices, you can see home prices grew on average by just over 56% nationwide over a five-year period. Some regions are slightly above or below that average, but overall, home prices gained solid ground in a short time. And if you expand that time frame even more, the benefit of homeownership and the drastic gains homeowners made over the years become even clearer (see map below): The second map shows, nationwide, home prices appreciated by an average of over 290% over a roughly 30-year span. This nationwide average tells you the typical homeowner who bought a house 30 years ago saw their home almost triple in value over that time. That’s a key factor in why so many homeowners who bought their homes years ago are still happy with their decision. And while you may have heard talk in late 2022 that home prices would crash, it didn’t happen. Even though home prices have moderated from the record peak we saw during the ‘unicorn’ years, prices are already rebounding in many areas today. That means, in most markets, your home should grow in value over the next year.The alternative to buying a home is renting, and rental prices have been climbing for decades. So why rent and deal with annual lease hikes for no long-term financial benefit? Instead, consider buying a home. If you’re questioning if it still makes sense to buy a home today, remember the incredible long-term benefits of homeownership. If you’re ready to start the conversation, let’s connect today. Check out our Beautiful Listings at https://davesalaskahomes.com/featured-listingSearch for homes easily at https://davesalaskahomes.com/listingGet your home’s estimated value instantly at https://davesalaskahomes.com/evaluation If you or anyone you know has ANY thoughts of buying or selling real estate, lets connect to talk about the opportunities available in our market and how to reach your goals. LET US BE YOUR TRUSTED GUIDE Call or text Dave now at 907-863-7289Call or text Travis now at 907-575-6779 davesalaskahomes@gmail.comhttp://www.DavesAlaskaHomes. com

Homebuyers Are Getting Used to the New Normal

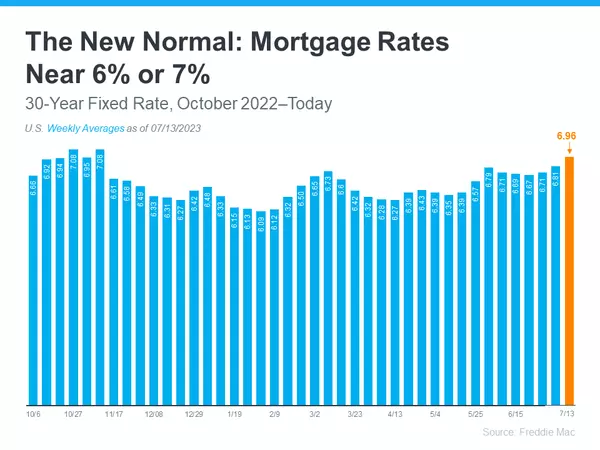

Before you decide to sell your house, it’s important to know what you can expect in the current housing market. One positive trend right now is homebuyers are adapting to today’s mortgage rates and getting used to them as the new normal. To better understand what’s been happening with mortgage rates lately, the graph below shows the trend for the 30-year fixed mortgage rate from Freddie Mac since last October. As you can see, rates have been between 6% and 7% pretty consistently for the past nine months: According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), mortgage rates play a significant role in buyer demand and, by extension, home sales. Yun highlights the positive impact of stable rates: “Mortgage rates heavily influence the direction of home sales. Relatively steady rates have led to several consecutive months of consistent home sales.” As a seller, hearing that home sales are consistent right now is good news. It means buyers are out there and actively purchasing homes. Here’s a bit more context on how mortgage rates have impacted demand recently. When mortgage rates surged dramatically last year, escalating from roughly 3% to 7%, many potential buyers felt a bit of sticker shock and decided to hold off on their plans to purchase a home. However, as time has passed, that initial shock has worn off. Buyers have grown more accustomed to current mortgage rates and have accepted that the record-low rates of the last few years are behind us. As Doug Duncan, SVP and Chief Economist at Fannie Mae, says: “. . . consumers are adapting to the idea that higher mortgage rates will likely stick around for the foreseeable future.” In fact, a recent survey by Freddie Mac reveals 18% of respondents say they’re likely to buy a home in the next six months. That means nearly one out of every five people surveyed plan to buy in the near future. And that goes to show buyers are planning to be active in the months ahead. Of course, mortgage rates aren’t the sole factor affecting buyer demand. No matter where mortgage rates stand, people will always have reasons to move, whether it’s for job relocation, changing households, or any other personal motivation. As a seller, you can feel confident there is a market for your house today. And that demand is pretty strong as buyers settle into where rates are right now. Bottom Line The way buyers perceive today’s mortgage rates is shifting – they’re getting used to the new normal. Steady rates are contributing to strong buyer demand and consistent home sales. Let’s connect so we can get your house on the market and in front of those buyers. Check out our Beautiful Listings at https://davesalaskahomes.com/featured-listingSearch for homes easily at https://davesalaskahomes.com/listingGet your home’s estimated value instantly at https://davesalaskahomes.com/evaluation If you or anyone you know has ANY thoughts of buying or selling real estate, lets connect to talk about the opportunities available in our market and how to reach your goals. LET US BE YOUR TRUSTED GUIDE Call or text Dave now at 907-863-7289Call or text Travis now at 907-575-6779 davesalaskahomes@gmail.comhttp://www.DavesAlaskaHomes. com

August 2023 Real Estate Market Update from Dave and Travis!

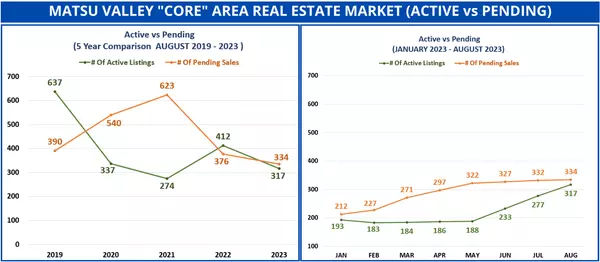

Here we are in August with Summer such as it was almost over! It can be hard to understand what is happening with residential real estate these days! Mortgage interest rates going up (the highest in 20 years!) & sales volume down significantly combined with LOW supply (still can’t find a home for many buyers), prices going up (about 5% so far this year) along with days on market! Its enough to give you whiplash!A little good news for homebuyers is that the days of many multiple offers seemingly is calming down.An example is our listing at 7600 Woodview Drive. We just pended this home after 8 days on the market..with 1 offer!A couple months ago we would have likely had multiple offers! We are seeing days on market increasing, price reductions and more expired listings.So the market is cooling for sure as I see it. Also just this week there were 4 appraisals in our office that came in below the agreed price. Pricing a home to attract a buyer AND get an appraisal takes much more experience & skill. We can help! Looking at the overall numbers supply (active listings) & demand (pending sales) remains pretty solid.We still have low inventory especially of existing homes. Sellers are holding back on selling and much of that has to do with the higher interest rates. Looking back over 5 years you can see the wild fluctuations between supply and demand (1st graph). We have about the same amount of active & pending sales currently.I think this will remain the same at around 300 units even with the slowdown. September #’s will be interesting! In 2023 YTD, we started the year in January with 193 active listings and 212 pending sales. Over the course of the year, both these numbers steadily grew, but pending sales consistently outpaced active listings.By August, the number of active listings had grown to 317, while pending sales slightly outpaced it at 334.The BIG question is will supply increase dramatically and or demand decrease as we move into Winter? Now lets look at the number of sales, average sales price and days on market for the last 5 years.First the number of sales is down about 40% from 2022 and about 20% from 2019! Certainly a big drop and pretty much what has happened nationwide. However the average sales price is higher than ever at $417,000, about a 4% increase from last year and a whopping almost 50% increase from 2019!This increase in equity has been unprecedented in the history of real estate. Normal appreciation is about 4% per year historically.Days on market are increasing as you would expect averaging 40 DOM for closed sales compared to 59 in 2019. Next lets look at the Mat-su Valley real estate market segmented by price range for August 2023. As expected the $250-450,000 price range is very active with 36% of the active listings, 57% of the pending sales and 57% of the closed sales. Average days on market in this price range are 31. This compares to the $450-650,000 range days on market of 62 with 35% of active listings, 23% of pending sales and just 25% of closed sales.If you have any questions or comments about these trends please reach out to me. I could use some opinions please! Your opinions matter a great deal to me! Next, lets take a look at the relationship between existing homes and new construction. The average sales price was $417,816 across all homes, with existing homes slightly lower at $402,495 and new constructions much higher at $471,905. Looking first at New construction homes: 33% (106) of active listings and 36% (112) of pending sales. Closed sales sit at 22% (183). 2022 saw 223 closed sales (18%) with 2019 showing 158 closed sales (15%). Builders are doing their part and what we really need to ease the lack of inventory is for lots more existing homes to come on the market! Travis and I are hustling trying to navigate help our people navigate,what’s going on with this market so any questions just let us knowand we look forward to any feedback you may have. Call us or simply reply to this email to set up a meeting. Check out our Beautiful Listings at https://davesalaskahomes.com/featured-listingSearch for homes easily at https://davesalaskahomes.com/listingGet your home’s estimated value instantly at https://davesalaskahomes.com/evaluation If you or anyone you know has ANY thoughts of buying or selling real estate, lets connect to talk about the opportunities available in our market and how to reach your goals. LET US BE YOUR TRUSTED GUIDE Call or text Dave now at 907-863-7289Call or text Travis now at 907-575-6779 davesalaskahomes@gmail.comhttp://www.DavesAlaskaHomes. com

Categories

Recent Posts