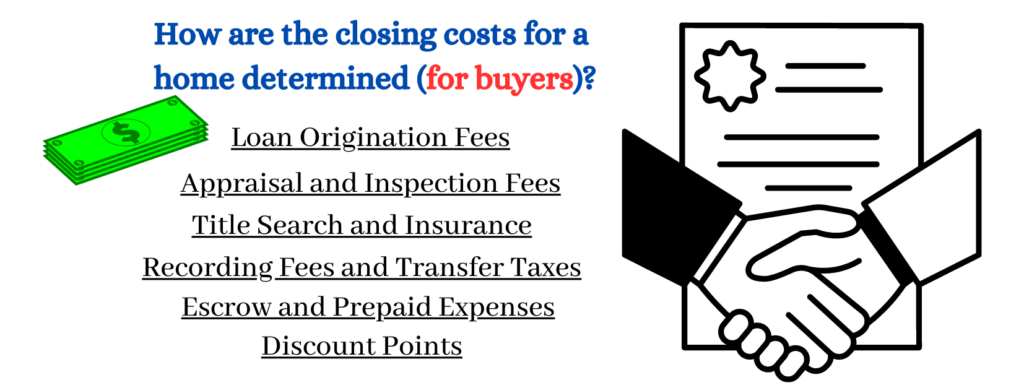

How are the closing costs for a home determined (for buyers)?

If you’re considering purchasing a property in the beautiful state of Alaska, understanding how closing costs are determined is essential to help you plan your budget and avoid any unwelcome surprises. So, let’s dive in and demystify the closing costs for home buyers.

What are Closing Costs?

Closing costs are the fees and expenses that both the buyer and the seller need to pay when finalizing a real estate transaction. These costs can vary greatly based on several factors, such as the property’s location, the lender’s requirements, and the terms of the contract. For home buyers, closing costs typically range from 2% to 5% of the home’s purchase price.

Factors Influencing Closing Costs for Buyers in Alaska:

Loan Origination Fees: One of the most significant closing costs for home buyers is the loan origination fee. This fee is charged by the lender for processing, underwriting, and funding the mortgage loan. The origination fee can be a flat amount or a percentage of the loan amount, typically ranging from 0.5% to 1%.

Appraisal and Inspection Fees: Before approving a mortgage, lenders require an appraisal to ensure the property is worth the loan amount. Appraisal fees usually range from $300 to $500. Additionally, home inspections are necessary to identify any potential issues with the property. Home inspection fees in Alaska can range from $300 to $600, depending on the size and location of the property.

Title Search and Insurance: To protect both the buyer and the lender from any ownership disputes, a title search is conducted to verify that the seller has the legal right to sell the property. The title search fee can range from $200 to $400. Additionally, title insurance is purchased to protect against any future claims on the property. Title insurance costs in Alaska can vary, but they typically range between $500 and $1,500.

Recording Fees and Transfer Taxes: Recording fees are charged by the local government to record the change of ownership in public records. In Alaska, recording fees can range from $100 to $300. Transfer taxes, on the other hand, are charged on the transfer of property ownership. Alaska has a statewide transfer tax of $2.00 for every $500 of the property’s value.

Escrow and Prepaid Expenses: Escrow fees are charged by the escrow company for managing the closing process and distributing funds to the appropriate parties. These fees can vary, but they typically range from $500 to $1,000. Prepaid expenses, such as property taxes, homeowner’s insurance, and mortgage interest, are also part of the closing costs. These amounts are prorated and can vary based on the closing date.

Discount Points: Some buyers choose to pay discount points, which are essentially prepaid interest on the mortgage. By paying discount points upfront, you can reduce your interest rate and overall mortgage costs. Each point typically costs 1% of the loan amount and can lower the interest rate by 0.25%.

Conclusion:

Closing costs are an inevitable part of the home buying process, and understanding how they are determined is essential for buyers. While these costs can be substantial, being aware of the factors that influence them can help you budget accordingly and be better prepared for your Alaska real estate transaction. As a buyer, it’s essential to work with an experienced real estate agent and lender who can guide you through the process and help you find ways to minimize your closing costs. Happy house hunting in the Last Frontier!

Check out our Beautiful Listings at https://davesalaskahomes.com/featured-listing

Search for homes easily at https://davesalaskahomes.com/listing

Get your home’s estimated value instantly at https://davesalaskahomes.com/evaluation

If you or anyone you know has ANY thoughts of buying or selling real estate, lets connect to talk about the opportunities available in our market and how to reach your goals.

LET US BE YOUR TRUSTED GUIDE

Call or text Dave now at 907-863-7289

Call or text Travis now at 907-575-6779

Categories

Recent Posts