2026 Mortgage Rates + Our First Closing of the Year From Dave and Travis!

Success Story! Real Stories, Real People, Real Homes First Closing of 2026 — Big Lake We kicked off the year with a great closing on two 40-acre properties in Big Lake , a full-circle moment that made this one especially meaningful. These properties belonged to longtime clients Lloyd and Bil

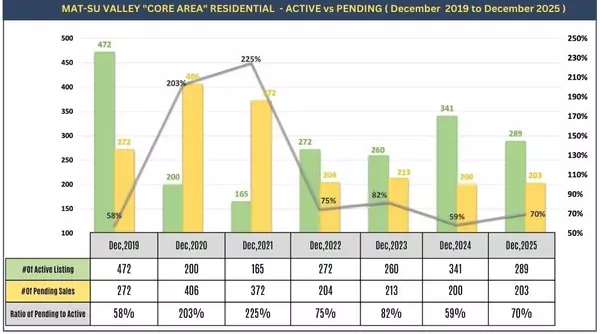

2025 Alaska Housing Market Year-End Report | What the Numbers Really Say From Dave and Travis

Success Story! Real Stories, Real People, Real Homes Riverside Property “From Earthquake Repairs to a Smooth 34-Day Close” This one came to us through a referral from another licensee up in Fairbanks we never actually got to meet the sellers in person! The home had a few challenges from p

Helpful Info for Anyone Affected by the Recent Wind Storm From Dave & Travis

We wanted to send this out quickly because the last four weeks of heavy wind here in the Mat-Su have been rough. We’ve seen sustained high winds at times close to hurricane force and unfortunately, a lot of people have been affected.I posted briefly about this and a good friend of mine, Brian Sherbu

Categories

Recent Posts