2025 Mortage Rate Forecast!

|

|

Categories

Recent Posts

Helpful Info for Anyone Affected by the Recent Wind Storm From Dave & Travis

A New Year Update: What’s New, Active & Sold in 2025 From Dave & Travis!

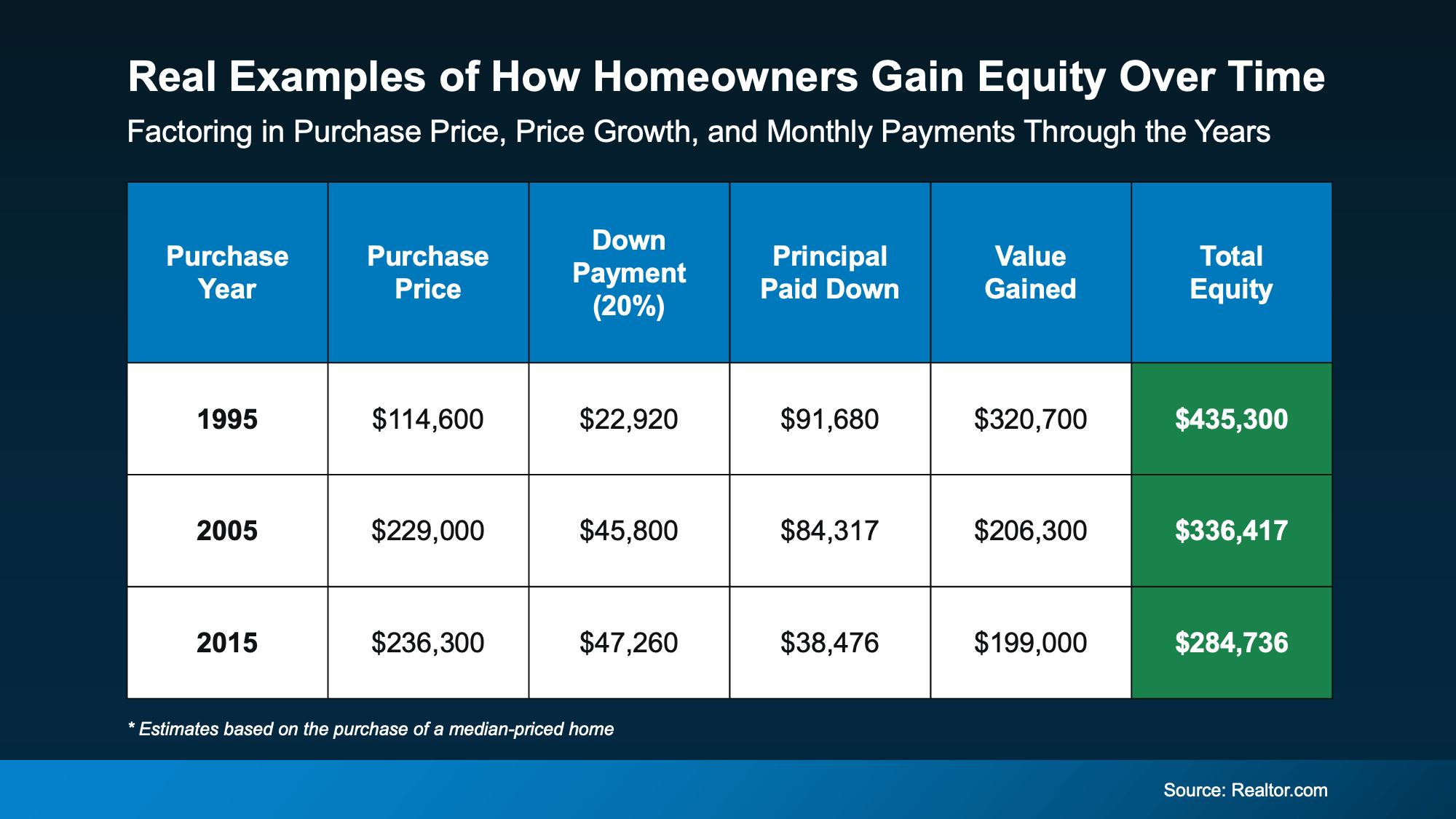

Your Equity Could Change Everything About Your Next Move

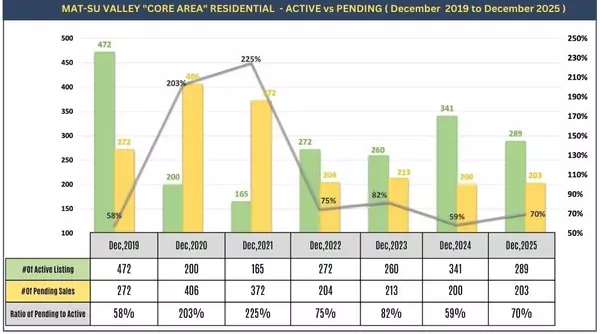

You’ll Hear These 3 Market Questions All Season (And a Must-Read Tree Safety Tip!)

Your December Market Snapshot Plus Creative Holiday Wrapping Tips from Dave & Travis!

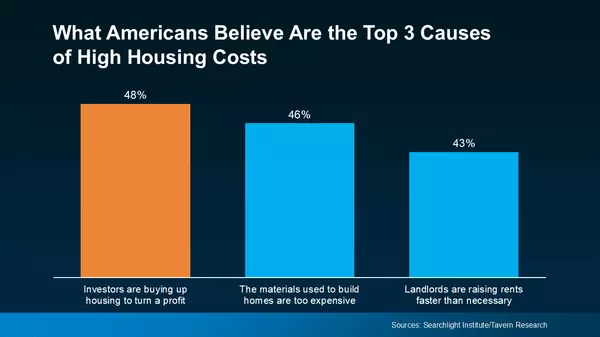

What’s Really Driving Home Costs and a Turkey Tips for Next Week from Dave and Travis!

Many Veterans Don’t Know about This VA Home Loan Benefit

New & Existing Homes; End-of-Month Market Snapshot from Dave and Travis!

2026 Housing Market Outlook with Dave & Travis!

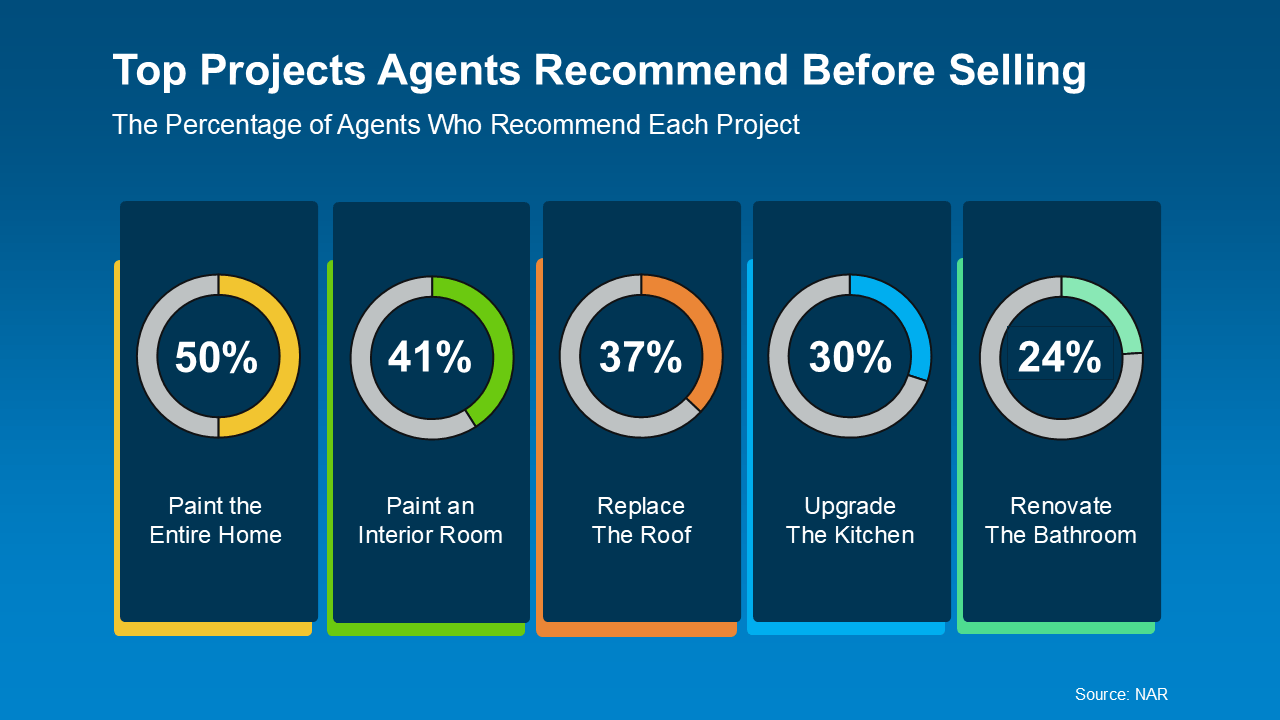

Planning To Sell in 2026? Start the Prep Now