Helpful Info for Anyone Affected by the Recent Wind Storm From Dave & Travis

We wanted to send this out quickly because the last four weeks of heavy wind here in the Mat-Su have been rough. We’ve seen sustained high winds at times close to hurricane force and unfortunately, a lot of people have been affected.I posted briefly about this and a good friend of mine, Brian Sherbu

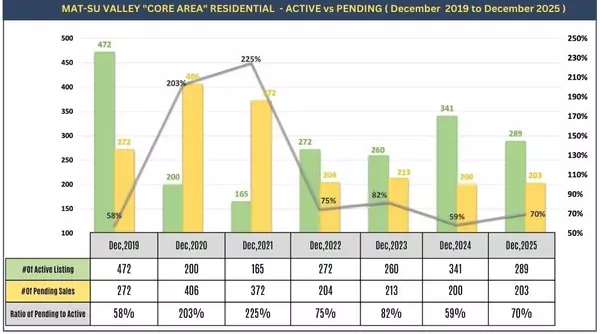

A New Year Update: What’s New, Active & Sold in 2025 From Dave & Travis!

As we step into a brand-new year, Travis and I want to start by saying thank you. We’re incredibly grateful to every client who trusted us this past year whether you were buying, selling, or simply asking questions and planning your next move. I’m excited to kick things off with a brand-new l

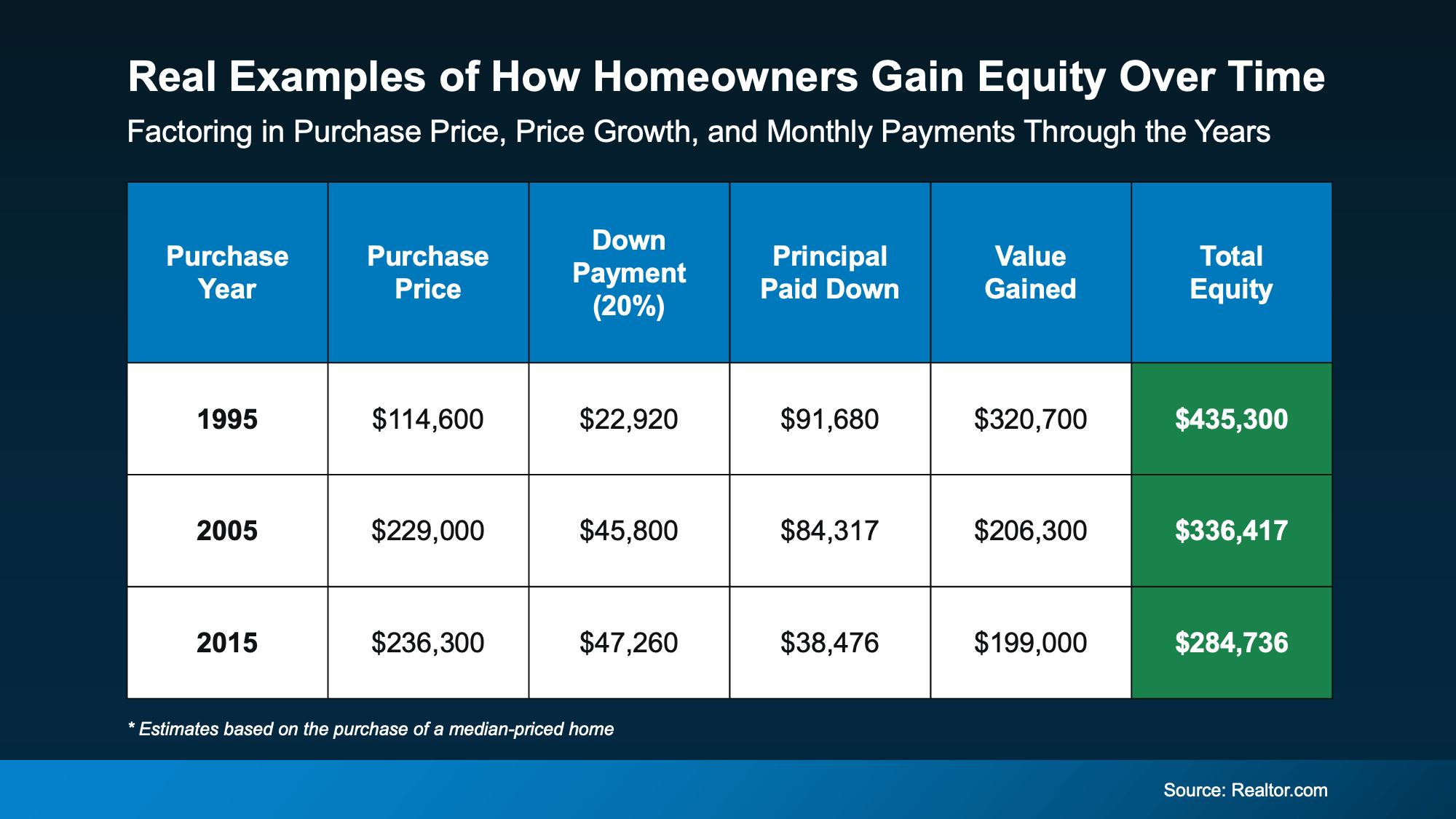

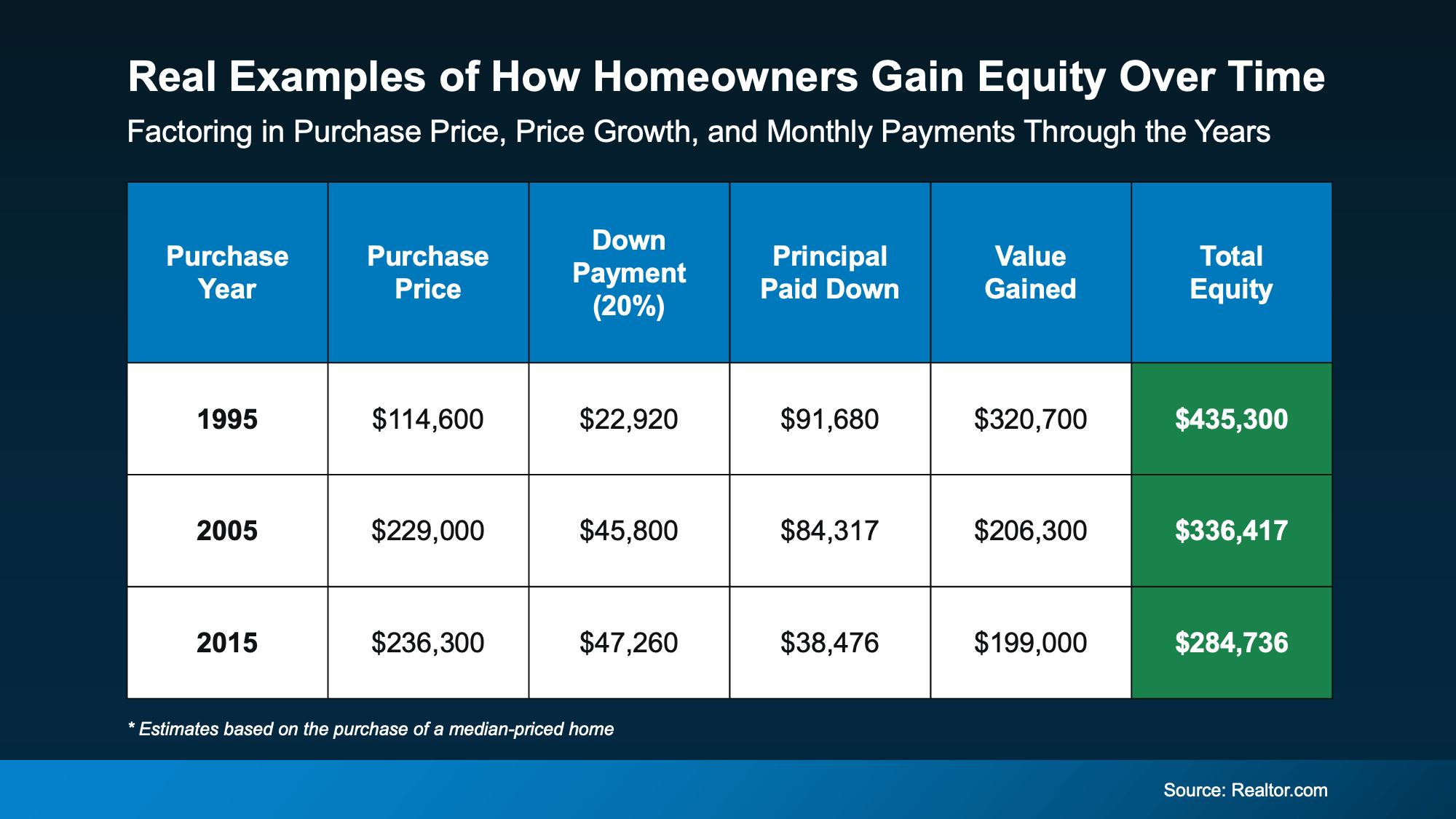

Your Equity Could Change Everything About Your Next Move

A lot of people are asking the same thing right now: “Is it even a good time to sell?” And the truth may come as a bit of a surprise... For many homeowners, the answer is a strong yes. Why? Because of one major factor working in your favor: your equity. Odds are, if you’ve lived in your home for a w

Categories

Recent Posts