Many Veterans Don’t Know about This VA Home Loan Benefit

|

|

|

|

|

|

|

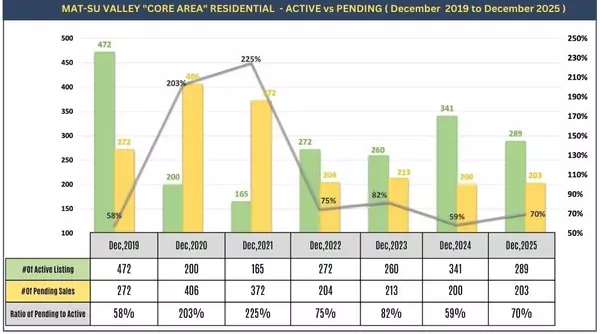

Whether you’re thinking of selling while prices are high or jumping in before rates or inventory shift again — now is the time to act. The Mat-Su markets are moving, and we’re here to help you navigate

LET US BE YOUR TRUSTED GUIDE

Call or text Dave now at 907-863-7289

Call or text Travis now at 907-575-6779

Categories

Recent Posts

2025 Alaska Housing Market Year-End Report | What the Numbers Really Say From Dave and Travis

Helpful Info for Anyone Affected by the Recent Wind Storm From Dave & Travis

A New Year Update: What’s New, Active & Sold in 2025 From Dave & Travis!

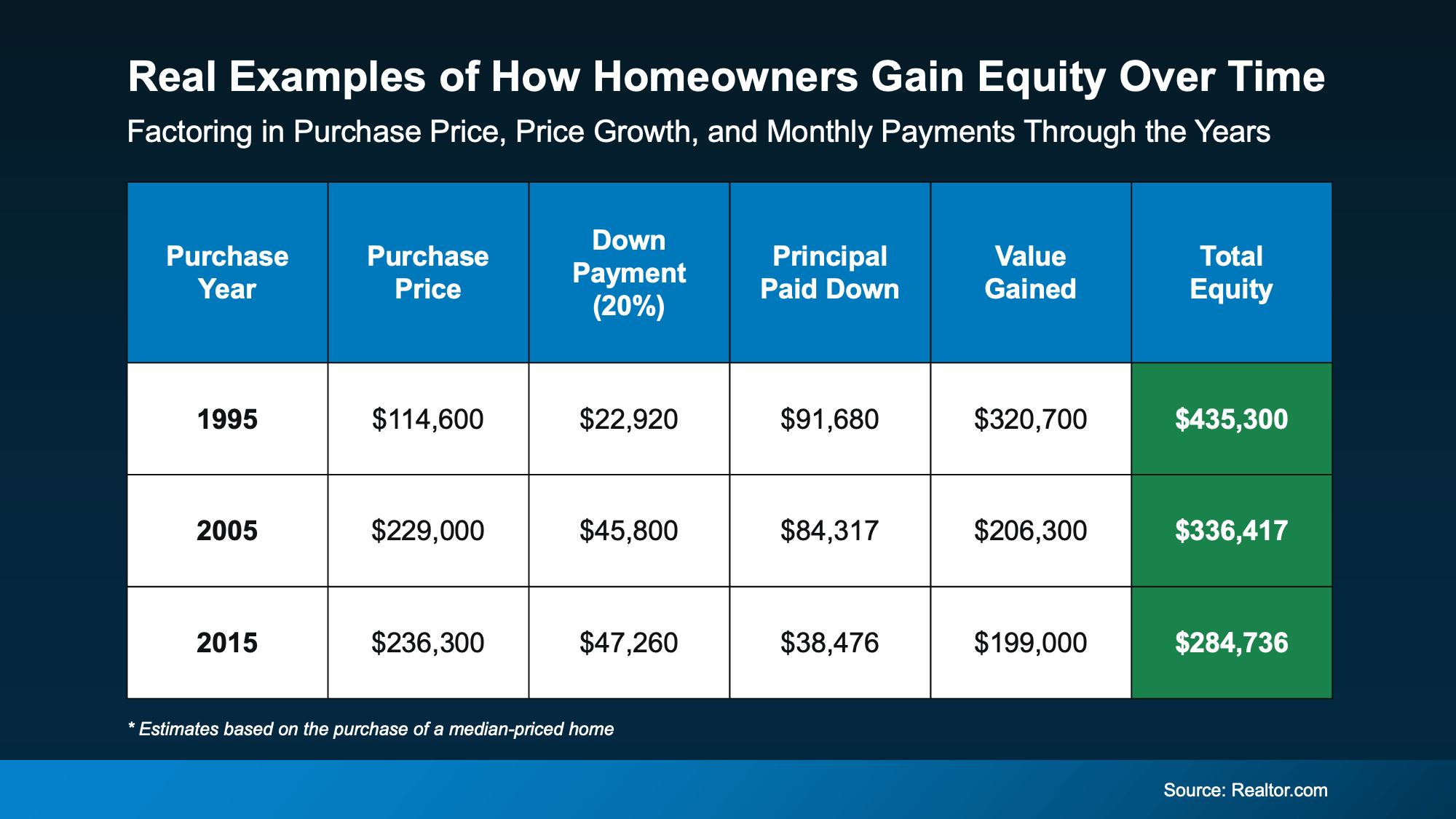

Your Equity Could Change Everything About Your Next Move

You’ll Hear These 3 Market Questions All Season (And a Must-Read Tree Safety Tip!)

Your December Market Snapshot Plus Creative Holiday Wrapping Tips from Dave & Travis!

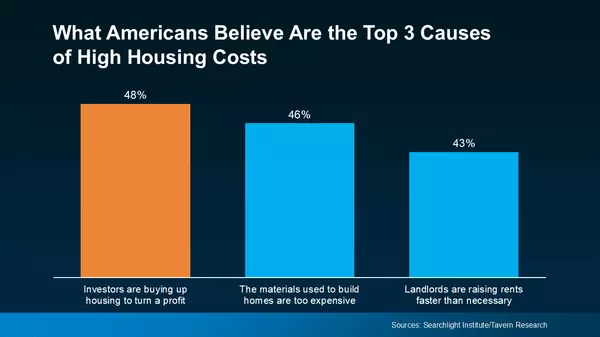

What’s Really Driving Home Costs and a Turkey Tips for Next Week from Dave and Travis!

Many Veterans Don’t Know about This VA Home Loan Benefit

New & Existing Homes; End-of-Month Market Snapshot from Dave and Travis!

2026 Housing Market Outlook with Dave & Travis!