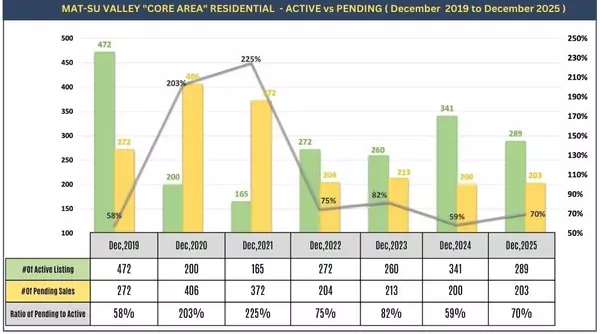

Your December Market Snapshot Plus Creative Holiday Wrapping Tips from Dave & Travis!

Success Story! Real Stories, Real People, Real Homes Frank & Jackie’s Next Chapter in Palmer Over a year ago, we were introduced to Frank and Jackie by their daughter to discuss selling their home a place they’d loved and lived in for over 40 years in Palmer. At that time, it just wasn’t the r

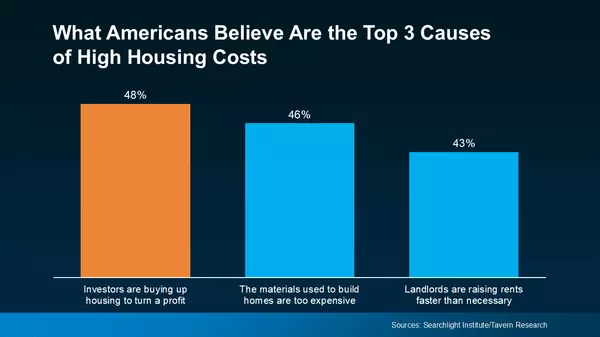

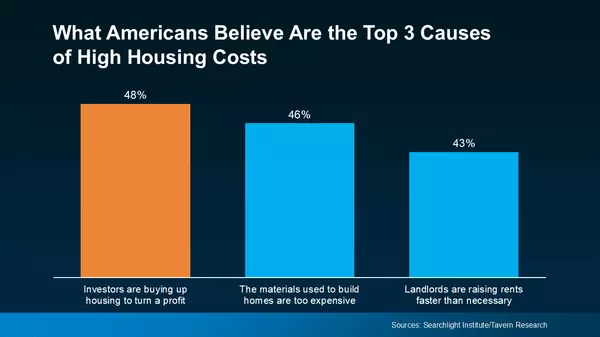

What’s Really Driving Home Costs and a Turkey Tips for Next Week from Dave and Travis!

Success Story! Real Stories, Real People, Real Homes Mary & Marvin's Alaska Homecoming! We were introduced to Mary & Marvin in March by their daughter who insisted we would do a great job. She was right, and we’re grateful she sent them our way.Their daughter also introduced them to Tracy Otti

Many Veterans Don’t Know about This VA Home Loan Benefit

For 80 years, Veterans Affairs (VA) home loans have helped countless Veterans buy a home. But even though a lot of Veterans have access to this powerful program, the majority don't know about one of its core benefits.According to a report from Veterans United only 3 in 10 Veterans are aware they may

Categories

Recent Posts