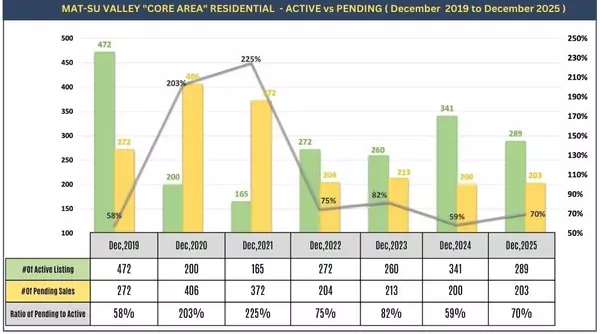

Across Alaska, we’re seeing similar conditions low inventory, slower sales activity, and prices continuing to rise modestly.

In Anchorage, the residential market shows 276 active listings (which should be closer to 600 for a balanced market) and 221 pending sales, down from 323 last year. The pending-to-active ratio dropped to 80% from 115% in 2024, while the average days on market rose to 24 (up from 22). The average sales price edged up to $527,000 from $514,000.

The Anchorage condo market follows the same pattern with 153 active listings (up from 109) and 107 pending sales (flat year-over-year). The ratio slipped to 70% from 98%, days on market stayed at 25, and prices climbed modestly to $289,000 from $275,000.

In Kenai, conditions are slower but steady. There are 322 active listings (down from 361) and 105 pending sales (down from 128), with a pending-to-active ratio of 33% (down from 36%). Homes are staying on the market longer — 65 days compared to 56 last year — and the average price remains flat at $387,000.

Statewide, the market mirrors these local trends. Active listings fell to 1,458 (from 1,683), while pending sales ticked up slightly to 708 (from 690). The pending-to-active ratio improved to 49% (from 41%), average days on market rose to 40 (from 39), and average sales prices increased to $464,000 (from $445,000).

While the number of closed sales remains strong compared to prior years, demand has slipped and days on market continue to climb. The real pressure point remains a lack of affordable inventory, combined with stubborn interest rates and broader economic uncertainty that’s affecting buyer confidence.

It’s a mixed market right now prices are up, but momentum is slowing. Sellers still benefit from low inventory, but realistic pricing and patience are key. Buyers may see more breathing room, but affordable homes remain scarce.

If you’d like a breakdown of what’s happening in your specific area or want to get an updated home value report, let’s connect!